Over the past year, Kazakhstan’s budget and public finance management has become much less transparent and accountable as the government has gained yet another off-budget means of financing government spending.

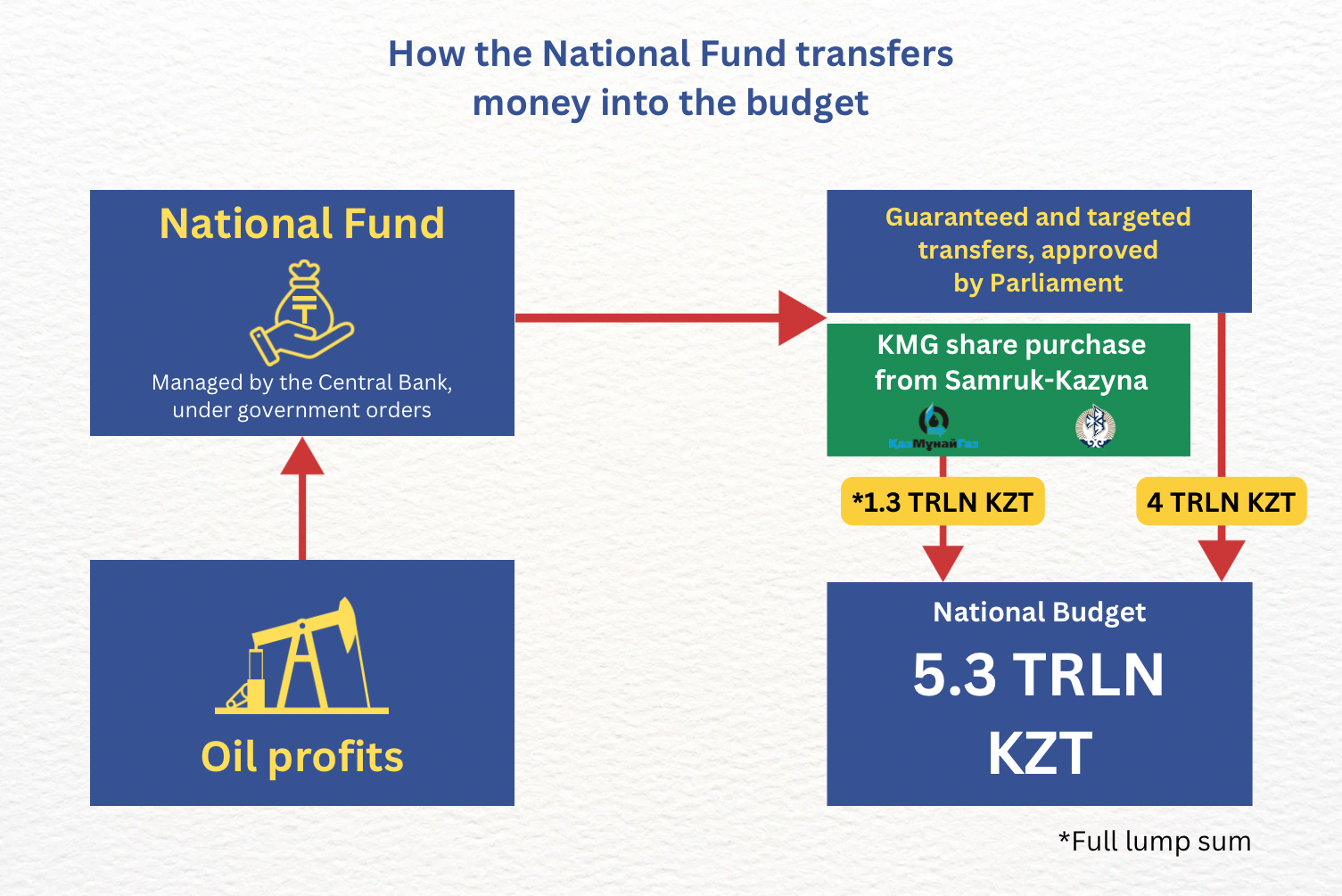

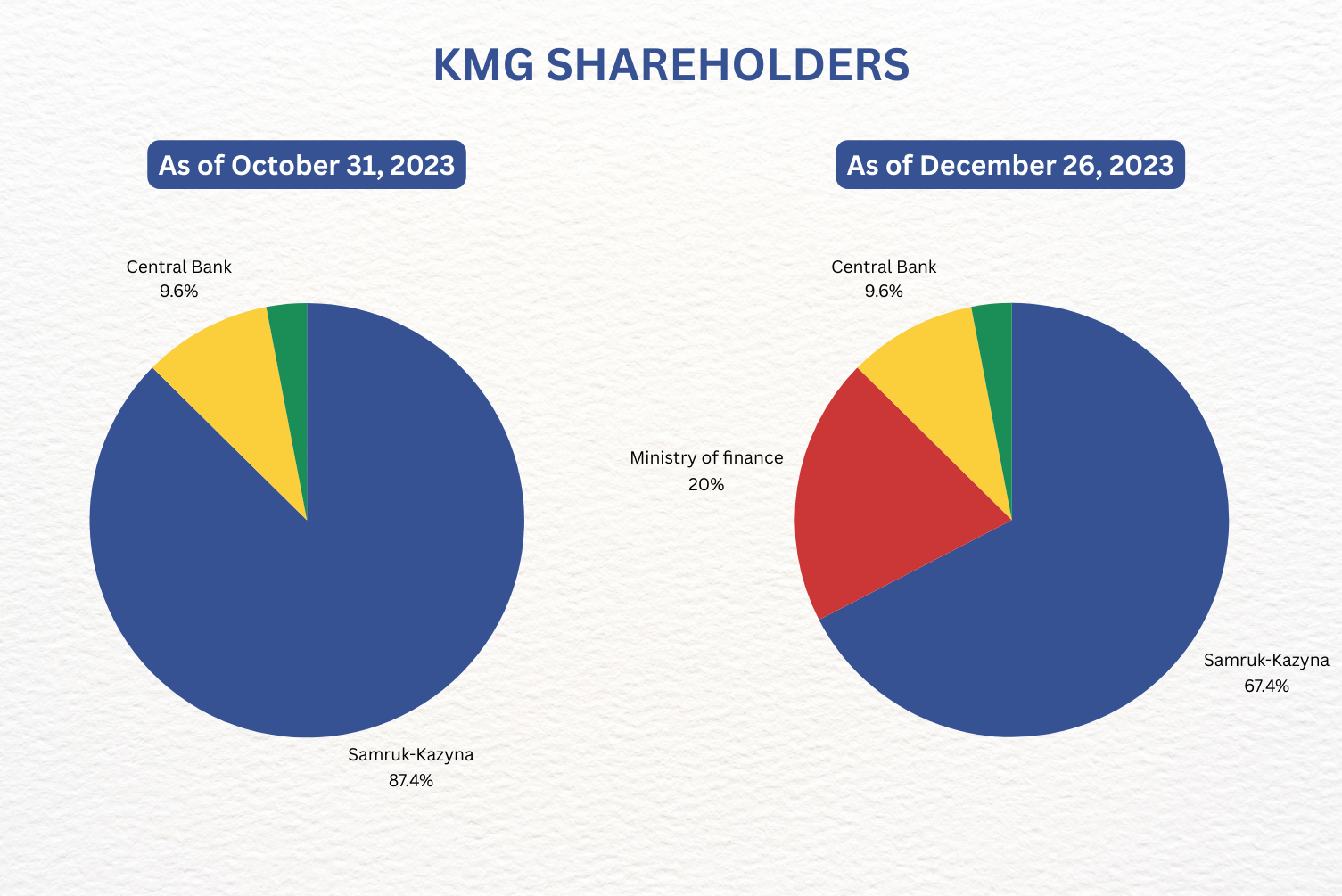

This method, set in stone by a government decree, is the sale of shares of Kazmunaigas (KMG), the national oil and gas company. The National Oil Fund, which is managed by the Central Bank, is the designated buyer of these shares. Samruk-Kazyna, the country’s sovereign welfare fund and holding company that owns a majority stake in KMG, sent the proceeds from selling KMG shares to the republican budget.

Through this new mechanism, kicked-off in late 2023, the government can essentially order transfers from the National Fund without prior approval from parliament. And the public will only learn about these transactions with KMG after they have been carried out.

The government amended the "Concept of Public Financial Management of Kazakhstan until 2030", a core document that regulates the use of state funds.

The consequences of this measure have puzzled analysts, who continue to ask questions about why the government needs this mechanism and where exactly the money from the sale of KMG shares went.

Paradoxes of Management

The amendments to the Concept are contradictory. On the one hand, the document narrows the possibilities for using National Fund’s assets, on the other hand, it makes room for additional uses.

In an effort to strengthen the savings function of the National Fund, the government proposed to curb spending by introducing a “cut-off” oil price, above which transfers would diminish. The principle is simple: when oil prices are high, producing companies pay more taxes, which means the budget deficit is lower and requires fewer injections from the National Fund. And from 2024, the guaranteed annual transfers should not exceed 2 trillion tenge ($4.4 billion).

At the same time, the amendments opened the door for the purchase of a 20% stake in KMG to finance the republican budget, as well as Samruk-Kazyna bonds to implement infrastructure projects commissioned by President Kassym-Jomart Tokayev.

According to the amended Concept, the National Fund can only buy shares and securities from KMG and Samruk-Kazyna.

The Central Bank referred to these amendments when it ordered, on government instructions, that the National Fund bought KMG shares worth 1.3 trillion tenge ($2.9 billion) from October to December 2023.

The new breakdown of KMG shareholders as of today’s publication is as follows: Samruk-Kazyna (67.4%), the ministry of finance (20%, purchased with National Fund capital), and the Central Bank (9.6%, purchased in 2015). The ministry of finance and the Central Bank entrusted their shares for the management of Samruk-Kazyna.

Budget Holes

Timur Suleimenov, the Central Bank’s chairman, justified the purchase of KMG shares, on the one hand, by the need to finance strategic infrastructure projects, and on the other, as a way to compensate for missing tax revenues.

For the first 11 months of 2023, around 5.6% of the planned budget revenues were missing, according to Halyk Finance analysts. This happened despite a 5.1% GDP growth, a record value over the past decade.

A sluggish growth in the oil and gas extraction as well as large-scale repairs to the sector’s key infrastructure caused a reduction in payments of corporate income tax, VAT on imports, mineral extraction tax and export tax on crude oil.

This did not allow the government to fill the gap with sharply increasing expenditures: By the end of November last year, budget expenditures had reached 23 trillion tenge ($50.8 billion), already more than the 2023 plan of 20.6 trillion.

According to Suleimenov, the decision to purchase KMG shares is unorthodox, but useful for balancing the budget. He warned several times that it should be considered a one-off measure and not a regular practice to replenish the missing income.

However, at the end of January, the ministry of finance published a draft government resolution, awarding it the right to purchase KMG shares at the expense of the National Fund for an indefinite period. The one-off measure is therefore poised to be repeated.

Why KMG?

In early January, the ministry of finance clarified that the acquisition of KMG shares cannot be considered as a withdrawal of National Fund assets. Instead, it is bookmarked as a potentially profitable investment, because the national company’s shares were purchased below the market price.

In an interview with Vlast, vice minister of finance Dauren Temirbekov pointed to the potential benefits given Samruk-Kazyna’s future plans to sell an additional 12.42% stake in KMG in the market.

“Since the shares were purchased at a discount [by the ministry of finance], they will be sold at a higher price at the secondary public offering. This income will go to the National Fund,” Temirbekov said.

Contradictions

Despite the government’s optimism, experts see several pitfalls in purchasing KMG shares through the National Fund.

According to Halyk Finance analyst Madina Kabzhalyalova, this practice undermines the stabilization function of the National Fund.

“High oil prices do not limit the transfers to the budget from the National Fund (the Concept described above, however, does set a limit - Ed.). Transfers, on the contrary, are increasing every year,” Kabzhalyalova told Vlast.

After the government’s decision to replenish the budget with 1.3 trillion tenge received from the sale of KMG shares, the size of withdrawals from the National Fund reached a record 5.3 trillion tenge (4 trillion of which are guaranteed and targeted transfers).

Another pitfall is that this practice leads to a lack of transparency in the budget policy.

Economist Kassymkhan Kapparov, who studies the management policy of the National Fund, said that the purchase of KMG shares is just an alternative way to withdraw money from the National Fund. He also added that parliament has never had control over the latter’s assets.

“Only members of the executive branch sit at the National Fund Management Council. The entire National Fund is regulated by presidential decrees. Parliament cannot regulate or block anything, it can only ratify something after the fact,” the economist told Vlast.

Doubts

The official budget report as of 1 January 2024 states that 1.3 trillion tenge was paid in 2023 to the budget as “dividends from state-owned shares,” without disclosing the breakdown of these dividends.

This amount significantly exceeds the initial plan for 2023 (211 billion tenge) and the actual result for 2022 (223 billion tenge). The budget received the 1.3 trillion tenge as dividends from the Samruk-Kazyna and Baiterek holding companies, as well as other national companies.

Temirbekov of the ministry of finance said that the entirety of the proceeds from the sale of KMG shares were transferred by Samruk-Kazyna to the budget. Samruk-Kazyna confirmed this statement to Kursiv, clarifying that it also paid taxes on the proceeds. The fund also confirmed that this money is classified as “dividends from state-owned shares.”

Since proceeds from the sale of KMG shares are combined with actual corporate dividends, it is impossible to understand the exact structure of the 1.3 trillion so-called “dividends” paid to the state, notes Sholpan Aitenova, director of the Zertteu Research Institute.

Therefore, we asked KMG, Samruk-Kazyna and the ministry of finance to provide a more precise breakdown of dividends to transparently show how income from the sale of KMG shares is accounted for.

While we wait for their answers, it is possible to highlight that the practice of direct purchase of KMG shares via the National Fund could be a symptom of another systemic problem.

Analysts from the Applied Economics Research Center (AERC) argue that by resorting to “easy” withdrawals from the National Fund, the government avoids building a balanced fiscal policy and public debt management strategy.

In his message to the people of Kazakhstan, President Tokayev said that one of the top priorities should be the resolution of the infrastructure crisis. Against this background, government spending is poised to increase, therefore widening the budget deficit.

According to the law regulating the 2024 budget law, expenditures will grow by around 8% compared to last year, to 23.3 trillion tenge. AERC expects the budget deficit to be 6.4 trillion tenge, or 5.5%, in 2024.

The National Fund's assets already cover more than 23% of the republican budget expenditures. Maintaining this trend would threaten the Fund’s assets, which would also go against the goal of increasing their volume to $100 billion by 2030, as Tokayev demanded from the government.

Поддержите журналистику, которой доверяют.