Kazakhstan’s economy grew by 6.2% in the first six months of 2025, the highest rate over the past 14 years. The government aims to keep this year’s GDP growth at around 6% by continuing to invest heavily in development projects.

However, it may be difficult to maintain this growth given the risks present both at home and abroad. As well as contending with an ongoing trade war, fluctuations in oil prices, and the major economies' central banks imposing tighter monetary policies, Kazakhstan is experiencing sluggish performance in its key industries, high inflation, and declining purchasing power amongst the population.

Despite wider economic growth, household incomes continue to fall due to the devaluation of the tenge, Kazakhstan’s local currency, and the rising cost of imported goods. Experts interviewed by Vlast differ in their assessments of Kazakhstan’s ability to curb inflation and sustain economic growth over the coming months.

Uneven Economic Growth

Over the first six months of this year, Kazakhstan’s industrial output rose by 6.5% compared to the same period in 2024. The mining (+8.4%) and manufacturing (+5.5%) sectors were the key drivers of this growth, accounting for 45.6% and 47.3% of total production respectively.

However, as Halyk Finance reports, the electricity, water, and gas sectors experienced much weaker growth. This stagnation suggests the economy’s gains may be less stable than it first appears.

First Deputy Prime Minister Roman Skylar disagrees with this assessment. During a government briefing in August, he told Vlast that the utilities sector cannot be viewed as directly linked to GDP growth.

“Modern companies are, after all, more focused on conserving resources,” he said.

Oil accounts for much of the growth in the mining sector, with higher output at Tengiz, one of Kazakhstan’s largest oil fields, boosting related industries. However, the completion of Tengizchevroil’s expansion project no longer guarantees an increasing oil output in the future.

Growth in manufacturing was driven by the food industry (+10%) and machinery production (+11.1%). Metallurgy, which accounts for 40% of manufacturing output, grew by only 0.1% because of the steel industry’s reduced output.

State Investment Keeping the Economy Afloat

Fixed capital investment by Kazakhstani enterprises rose by 19.3% in the first half of 2025, totalling 8.1 trillion tenge ($15.4 billion). Halyk Finance’s report attributes the jump to a fall in investment last year, inflating this year’s figures, along with government investment in infrastructure. In the private sector, overall investment increased by a modest 8.4%.

Investment continues to decline in the mining sector (-17.9%) following the completion of an earlier project at Tengiz. Investment surged in the chemical (+79.4%), food (+48%), and transport (+16.2%) industries while metallurgy, which accounts for almost a quarter of all investment in manufacturing, grew 4%. In utilities there was a twofold increase, helped by last year’s unusually low levels.

Investment from the private sector is decreasing, while state investment is on the rise. Companies’ funds now account for just 64.6% of total investment, while the share of the state budget grew to 21.9%. Most of the money is going into construction, while spending on equipment and technology is falling. Bank lending to the economy continues to decline.

As analysts at Halyk Finance suggest, the growth of private investments is still limited by high inflation, tight monetary policy, and currency volatility. Unless the government increases its spending or provides incentives to private investors, declining private investment may slow GDP growth in the future.

Skylar stressed that despite this, fixed capital investment has remained stable and these statistics can be attributed to ongoing engineering and transport infrastructure projects, which are normally financed by the state.

“We are increasing state investment. We are focusing on the manufacturing sector, but the mining and metallurgical sector is also a priority for us… We are not interested in exporting raw metal ores, we want to carry out the processing of these raw materials at home. This is the case not only for solid minerals, but also for oil, gas, and chemicals.”

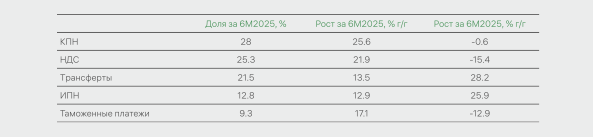

Government revenues also rose 17.6% in the first half of the year, reaching 14.5 trillion tenge ($27.1 billion). Tax revenues hit 98.1% of the target, while contributions from the National Fund added another 3.1 trillion tenge ($5.8 billion). By the end of the year, these contributions are expected to account for 21.5% of all government revenue.

Both tax and non-tax revenues exceeded their target by 4.9% and 42.4% respectively. The increase in non-tax revenues was largely driven by fines, accounting for 25% of all non-tax revenues.

In spite of these figures, economist Kassymkhan Kapparov predicts that tax revenues could fall further as large companies are choosing to re-register under the jurisdiction of the Astana International Financial Centre (AIFC), where they can legally benefit from lower taxes.

“This will impact government revenue, as corporate income tax may be lower than before. Smaller businesses may also start favoring the shadow economy amid rising VAT and shrinking tax revenues, while volatile oil prices add another layer of risk. I think we will see a larger decline in tax revenues this year, potentially widening the country’s budget deficit.”

The government can also rely on tried and tested methods of narrowing the budget deficit through borrowing from international markets, using National Fund resources to sell shares in state-owned enterprises, or temporarily lowering the tenge exchange rate. However, Kapparov believes these are only temporary fixes, which fail to address deeper structural problems, undermining the government’s ability to fund services for the population.

Inflation’s Impact on Income

Halyk Finance analysts also emphasize that the price of goods and services has risen dramatically since the beginning of the year. By early July, annual inflation reached 11.8%, driven largely by non-food goods (+9.4%) and consumer-paid services (+16.1%).

Although food inflation usually eases in summer, prices did not come down this year.

According to Halyk Finance, this is due to Kazakhstan’s heavy reliance on imported food, primarily from Russia, where high levels of inflation persist.

However, economist Ayakoz Khanet believes there are still reasons to expect inflation to ease over the next six months, despite a considerable degree of uncertainty. Kazakhstan already has a high benchmark interest rate (16.5%), which restricts lending to the economy and is likely to be reinforced by more restrained fiscal policy in the future.

“Bringing down inflation requires coordinated action by both fiscal and monetary authorities. As well as having trust in the authorities, the population and businesses must have confidence inflation will decrease. Without this, an inflationary spiral emerges as people and companies begin to hike up prices and stockpile goods, accelerating the rate of inflation.”

Khanet identifies several key consequences of high inflation: a worsening investment climate, rising costs for major producers that squeeze profit margins and reduce orders for small businesses, and weakening household purchasing power, particularly for families who spend 60-70% of their income on food and basic utilities.

“Another consequence is the erosion of trust, both in the national currency and in economic policy more broadly. When people are concerned about inflation, they opt to use the dollar and reduce their savings in tenge, placing even more strain on monetary policy.”

According to Halyk Finance, high inflation has been impacting wages for several months. In the first quarter, nominal monthly incomes rose nearly 11% to 423,000 tenge ($900), but when adjusted for inflation, incomes have been falling since early March.

Sociologist Serik Beissembayev highlights that opinion polls conducted by Demoscope show people consistently cite high inflation and declining income among their top concerns and in recent years, they have increasingly begun linking these problems with corruption.

“People associate corruption with the country’s political system. In particular, we see a noticeable increase in negative evaluations. Incomes are not adjusting for inflation and an expansion of the welfare state has not translated into a higher standard of living. People are losing confidence that the situation will improve, or that the government can deliver on jobs, higher wages, and pensions.”

Kapparov points out that household incomes have been stagnant for some time. Figures pointing to rising consumption are being driven by a surge in consumer lending.

“Without a considered effort to boost incomes, consumer lending will continue to rise. Whether or not people can take on new loans is uncertain, because the part of the population that finances its consumption through credit is already heavily indebted.”

Beissembayev, citing surveys and focus groups, believes that household debt has already reached its limit. People are struggling with heavy debt burdens, forcing them to look for additional work.

“The requirement to take on additional work takes an emotional toll. People cannot relax or spend time with their families leading to a rise in health issues along with increased aggression and intolerance in society.”

Kapparov believes that those in debt urgently need government assistance and considers it necessary to tighten consumer lending regulations, despite resistance from banks.

Although the increase in VAT takes effect in 2026, he believes consumers will feel most impacted by inflation in the second half of the year as prices for goods and services are already rising. This is exacerbated by an almost 6% drop in the tenge against the dollar, which will lead to a short-term increase in the cost of imported goods.

“At present, the government is unable to address low incomes or rising prices. Slowing the pace of tariff increases is unlikely to help and persistent high inflation will continue negatively affect purchasing power,” Kapparov concludes.

Beissembayev believes that rather than addressing the problem, the government is creating social tensions by transferring the economic burden onto citizens through a VAT hike.

“The worse people’s situation becomes, the greater the discontent. This could result in rising public unrest and growing criticism of both the president and government as a whole.”

An edited version of this article was translated by Beatrice Learmouth.

Поддержите журналистику, которой доверяют.